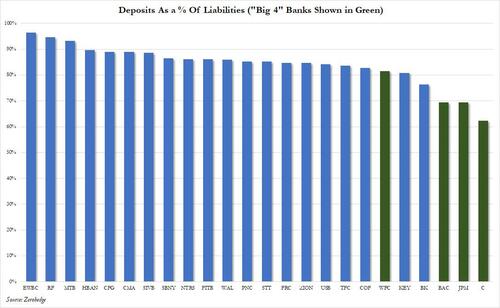

Over the weekend, when parsing through the carnage sweeping the US banking sector, we analyzed which banks are facing the highest deposit-run risk in the aftermath of the SIVB – and now SBNY – failures, and focused on a handful of names who have the bulk of their funding in the form of deposits – deposits which are now suddenly at risk amid what seems to be a major bank run.

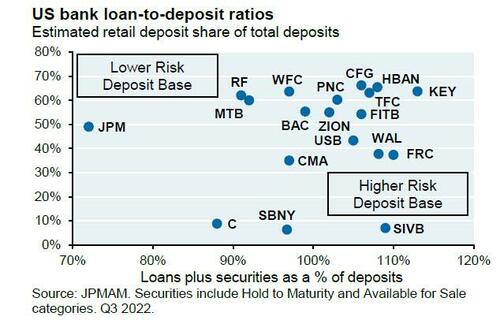

JPM’s Michael Cembalest – whose bank is poised to benefit the most from the ongoing carnage – chimed in with the following chart, which added an additional axis looking at loans plus securities as a % of total deposits, but which after the new BTFP bailout facility is irrelevant since the Fed and TSY are effectively backstopping unrealized losses on securities.

So we are really down to which banks have the most bank run risk, which as we explained, are primarily America’s small, regional banks.

How are they holding up today? Well, not good: here is the KRE index…

$KRE down 30% in past week, a rare short-term plunge for something so diversified. pic.twitter.com/9zUWJzODYR

— Eric Balchunas (@EricBalchunas) March 13, 2023

… while its consttiuent members are having a very bad day as the following headlines reveal:

- *FIRST REPUBLIC BANK HALTED FOR VOLATILITY, DOWN 65%

- *PACWEST HALTED FOR VOLATILITY; DROPPED 41% TO LOWEST ON RECORD

- *REGIONS HALTED FOR VOLATILITY AFTER PARING 31% DROP TO 20%

- *WESTERN ALLIANCE SINKS A RECORD 76%; HALTED FOR VOLATILITY

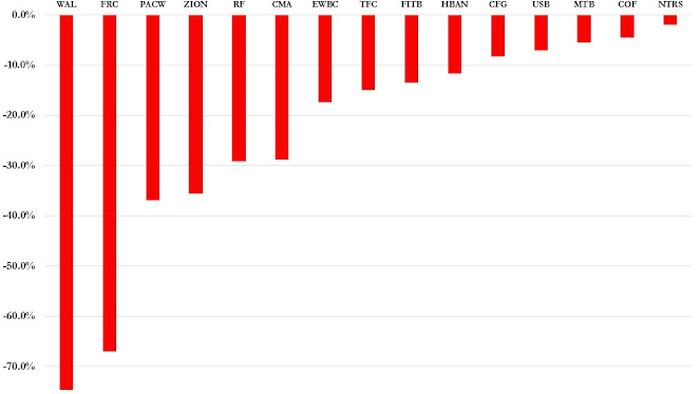

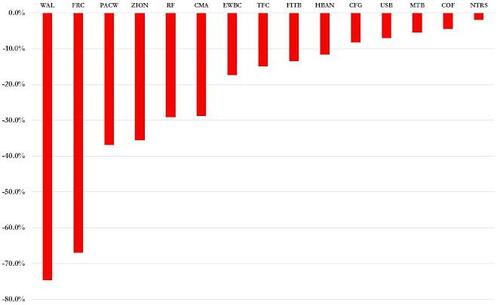

And this is how the various small banks are doing today.

The take home here is that, unfortunately, Joe Biden’s 9am pep talk did little to boost confidence in small US banks.

Or, as we put it earlier, “”It would be the Savings and Loan 2.0 Crisis but we regret to inform you there are no savings.” Meanwhile, all hail JPMorgan, pardon, JPMega, which is about to have some $18 trillion in deposits.

Source Link: https://www.zerohedge.com/markets/small-banks-are-crashing

Bitchute: https://www.bitchute.com/channel/YBM3rvf5ydDM/

Telegram: https://t.me/Hopegirl587

EMF Protection Products: www.ftwproject.com

QEG Clean Energy Academy: www.cleanenergyacademy.com

Forbidden Tech Book: www.forbiddentech.website

![THE POD LIFE [2023-04-08] – DAVE CULLEN (VIDEO)](https://www.hopegirlblog.com/wp-content/uploads/2023/04/THE-POD-LIFE-2023-04-08-DAVE-CULLEN-VIDEO-440x264.jpg)